Wednesday, September 21, 2005

There is little more to say in the abstract than this.

Tuesday, September 20, 2005

E-mail suggests government seeking to blame groups - The Clarion-Ledger

One of the keys for reading the National Review, as AngryBear often notes, is realising that what they say often has no relation to reality.

Apparently, their geography is often as poor as their economics.

Apparently, their geography is often as poor as their economics.

Whoever is behind the e-mail may have spotted the Sept. 8 issue of National Review Online that chastised the Sierra Club and other environmental groups for suing to halt the corps' 1996 plan to raise and fortify 303 miles of Mississippi River levees in Louisiana, Mississippi and Arkansas.

The corps settled the litigation in 1997, agreeing to hold off on some work until an environmental impact could be completed. The National Review article concluded: "Whether this delay directly affected the levees that broke in New Orleans is difficult to ascertain."

The problem with that conclusion?

The levees that broke causing New Orleans to flood weren't Mississippi River levees. They were levees that protected the city from Lake Pontchartrain levees on the other side of the city.

Monday, September 19, 2005

How the Liberals Lost the Dialogue, Part 1 of a Series

In the grand tradition of "you've got to be in it to win it" (or, as the old joke goes, "Meet me halfway, Morrie. Buy a ticket!"), the CNBC Squawk Box Guest List for today:

Mark McClellan

Centers for Medicare & Medicaid Services Administrator

Greg Valliere

Stanford Washington Research Group

Chief Political Strategist

Scott Amey

Project on Government Oversight

General Counsel & Lead Investigator

Tim Seymour

Red Star Asset Management

Managing Partner

Robert Bixby

The Concord Coalition

Executive Director

John Brady

Man Financial

Senior Vice President

Tom Schatz

Citizens Against Government Waste

President

Michael Cuggino

Permanent Portfolio Fund

Oliver Sartor

Stanley Scott Cancer Center, LSU

Mark McClellan

Centers for Medicare & Medicaid Services Administrator

Greg Valliere

Stanford Washington Research Group

Chief Political Strategist

Scott Amey

Project on Government Oversight

General Counsel & Lead Investigator

Tim Seymour

Red Star Asset Management

Managing Partner

Robert Bixby

The Concord Coalition

Executive Director

John Brady

Man Financial

Senior Vice President

Tom Schatz

Citizens Against Government Waste

President

Michael Cuggino

Permanent Portfolio Fund

Oliver Sartor

Stanley Scott Cancer Center, LSU

How to Describe a Month, CNBC-style

CNBC just listed the four largest month-on-month drops in Consumer Sentiment. #1 is this month (Katrina). #2 was described as "Before Recession" (possibly the 1973 oil price spike). #3 was was in 1990, and noted as "End of Recession."

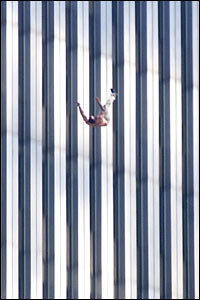

#4--September of 2001--was also described as "End of Recession."

Yeah. that's always the way I'll think of September of 2001.

#4--September of 2001--was also described as "End of Recession."

Yeah. that's always the way I'll think of September of 2001.

Friday, September 16, 2005

Reality Bites Oligopolies Too - Sep. 16, 2005

Reality Bites: "Mistakes that caused bad times were made in good times: Management at fault in bankruptcies"

Which leaves the question: if managers should be compensated for their performance, why does such compensation tend to be a one-way street?

Check out the graphic at the right. Of the seven largest airlines, five are at or near bankruptcy. The other two are Continental and Southwest.

The Southwest story is well-discussed everywhere. Continental, in my humble opinion, has the best Customer Service department of all the airlines. This doesn't mean they are perfect--they once took 24 hours to return a suitcase to me that never left their possession, and which they originally mistagged--but they try and they work with you.

In an oligopolistic industry, it's often too easy to think of advertising as the best way to differentiate your product. But customer service leads to "free" advertising (i.e., word of mouth), which would seem to be more effective.

Just as the people at Doesn't Ever Leave The Airport, whose effective monopolies and resultant pricing power in several locations (Cincinnati, Atlanta, etc.) doesn't seem to have carried the day.

Which leaves the question: if managers should be compensated for their performance, why does such compensation tend to be a one-way street?

Check out the graphic at the right. Of the seven largest airlines, five are at or near bankruptcy. The other two are Continental and Southwest.

The Southwest story is well-discussed everywhere. Continental, in my humble opinion, has the best Customer Service department of all the airlines. This doesn't mean they are perfect--they once took 24 hours to return a suitcase to me that never left their possession, and which they originally mistagged--but they try and they work with you.

In an oligopolistic industry, it's often too easy to think of advertising as the best way to differentiate your product. But customer service leads to "free" advertising (i.e., word of mouth), which would seem to be more effective.

Just as the people at Doesn't Ever Leave The Airport, whose effective monopolies and resultant pricing power in several locations (Cincinnati, Atlanta, etc.) doesn't seem to have carried the day.

Thursday, September 15, 2005

How much can Manager Skill Matter? (Aug 29 catch-up)

Forbes reports that the Washington Redskins are the most valuable franchise in the NFL.

Can anyone who has watched the team under Dan Snyder's ownership and control (effectively, management) explain how the relative value of the franchise appreciated by at least 6.5% per year from the time Snyder bought the team for $800 million in May of 1999 and the Forbes article in 2004?

Note: Forbes declares that Snyder paid $750MM, while the Redskins's website declares $800MM. Using the Forbes figure would produce a return of just under 8% p.a.

Can anyone who has watched the team under Dan Snyder's ownership and control (effectively, management) explain how the relative value of the franchise appreciated by at least 6.5% per year from the time Snyder bought the team for $800 million in May of 1999 and the Forbes article in 2004?

Note: Forbes declares that Snyder paid $750MM, while the Redskins's website declares $800MM. Using the Forbes figure would produce a return of just under 8% p.a.

Sunday, September 04, 2005

The Value of Employee Retention

A friend who is rather more optimistic than I noted that the skills the current Administration has not displayed during Katrina ("Knowledge of crowd control, logistics and the military operations, command structure and control? Along with some political savvy?") are all present in one person--former

Secretary of State Colin Powell.

If Employee Retention is valuable--I believe it is, though the base metric varies by industry--why do the macro business models not consider it?

And, to the extent that it is valuable, should the value of outsourcing be reduced proportionately?

Secretary of State Colin Powell.

If Employee Retention is valuable--I believe it is, though the base metric varies by industry--why do the macro business models not consider it?

And, to the extent that it is valuable, should the value of outsourcing be reduced proportionately?

Thursday, September 01, 2005

If you ban a market, cui bono?

The petition was popular last year. This year, the legislature, never known for its perspicacity, made the move: U.K. moves to ban violent sex on Net. Well, not the presence of violent sex on the Net; just knowing about it:

Ignoring the legal questions (e.g., what is "serious violence"?) and giggling at the disclaimers ("the government said it did not plan to prosecute people who accidentally stumbled across the images"), this is a markets question.

If you make a living selling imagery, including that which is a "graphic and sexually explicit and which contains actual scenes or realistic depictions of serious violence, bestiality or necrophilia," then the economy is willing and able to "clear" your transaction such a manner as to make it worth your while to produce those depictions.

What is the effect on demand--and on price--if the available commodity is then banned in one form (but, notably, no others)?

(As an aside, I can think of several episodes of, for instance, Millennium that may count, if they were viewed as streaming video. Depending on enforcement decisions.)

The two most obvious natural beneficiaries of the law should be:

1. Adult Video Stores (those who choose not to risk downloading shopping elsewhere), and

2. Producers of violent-sex material (who go from being price-takers to price-makers, and are compensated for their greater risk.

Am I missing anyone?

On Tuesday the government agreed, announcing plans --- the first, it said, by any Western country --- to ban the downloading and possession of violent sexual images.

Ignoring the legal questions (e.g., what is "serious violence"?) and giggling at the disclaimers ("the government said it did not plan to prosecute people who accidentally stumbled across the images"), this is a markets question.

If you make a living selling imagery, including that which is a "graphic and sexually explicit and which contains actual scenes or realistic depictions of serious violence, bestiality or necrophilia," then the economy is willing and able to "clear" your transaction such a manner as to make it worth your while to produce those depictions.

What is the effect on demand--and on price--if the available commodity is then banned in one form (but, notably, no others)?

(As an aside, I can think of several episodes of, for instance, Millennium that may count, if they were viewed as streaming video. Depending on enforcement decisions.)

The two most obvious natural beneficiaries of the law should be:

1. Adult Video Stores (those who choose not to risk downloading shopping elsewhere), and

2. Producers of violent-sex material (who go from being price-takers to price-makers, and are compensated for their greater risk.

Am I missing anyone?

RBC and u* (for 30 Aug)

David Altig, Angry Bear, and Max, among others, have been discussing this paper by Robert Hall, in which he discusses neoclassical economics and Kydland [Thank you, Tom] and Prescott's RBC (real business cycle) model in loving detail.

Hall notes that the neoclassical model is an economy in which "production functions, consumption demand functions and labor supply functions" are "embedded in markets that clear."

Now, if the markets clear--that is, if all transactions make economic sense to all participants, given their information at the time--why would the same not be true of the "natural" rate of unemployment (u*)? It would seem that the neoclassical model implies that any unemployment rate above zero would be a sign that potential GDP (y*) has been lost.

What am I missing?

Hall notes that the neoclassical model is an economy in which "production functions, consumption demand functions and labor supply functions" are "embedded in markets that clear."

Now, if the markets clear--that is, if all transactions make economic sense to all participants, given their information at the time--why would the same not be true of the "natural" rate of unemployment (u*)? It would seem that the neoclassical model implies that any unemployment rate above zero would be a sign that potential GDP (y*) has been lost.

What am I missing?

Obviously Lying with Statistics

Advert on CNBC from a company helping to reduce business debt:

Text 1: 4 Businesses Fail Every Minute.

Text 2: 40,000 Businesses Fail Every Month.

What's wrong with this, you ask?

60 minutes in an hour * 24 hours in a day * 30 days in a month = 43,200 minutes/month

So if the first were true, that would be ca. 173K failures a month.

Given that their mathematical skills are that bad, why would anyone use the firm for debt relief?

Text 1: 4 Businesses Fail Every Minute.

Text 2: 40,000 Businesses Fail Every Month.

What's wrong with this, you ask?

60 minutes in an hour * 24 hours in a day * 30 days in a month = 43,200 minutes/month

So if the first were true, that would be ca. 173K failures a month.

Given that their mathematical skills are that bad, why would anyone use the firm for debt relief?